Our recent research with smart speaker owners provided a look at the device landscape and led to design best practices for developing voice-activated applications. Now we're delving into the implications of our findings for individual industries. Our last article looked at retail-specific smart speaker findings. Today we look at the financial management tasks smart speaker owners are (and aren't) interested in performing with the help of a voice assistant.

Our research found that of any market, financial services faces the greatest challenges in terms of adopting voice technology and leveraging this new platform. Overall, a lower percentage of smart speaker owners were interested in financial products and services delivered via voice interface than were interested in other categories.

Of the smart speaker owners we surveyed:

- Less than 30% were interested in applying for a credit card.

- Less than 40% were interested in checking their credit score.

- Less than 40% were interested in getting financial advice.

Further, this sector had the

highest negatives when it came to voice-enabled interactions:

Finally, the demographic most attractive to financial services firms (people over 55 years old) were far more likely to say they were Not At All Interested than were younger age groups.

So, what’s going on here?

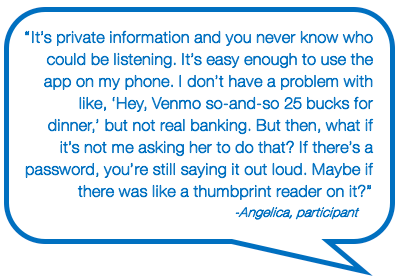

In interviews, participants’ primary reasons for not wanting financial services via smart speaker voice assistants were concerns about security.

Some, due to concerns about hacking, kept their financial information in as few places as possible. Some didn’t like that they might be overheard, and for many, the smart speaker was a family device in a common space--without some form of password or biometric authentication, they were uninterested in having personal financial information accessible by the household and guests. Even password/security phrase/security questions didn’t alleviate this concern for some, who felt these authentication methods in voice interfaces could be overheard.

That said, it was not long ago that people balked at the idea of managing their personal finances through the web. We heard many of the same concerns in the early days of mobile banking. In each case, developments in security technology and new ways of designing for user confidence were brought to bear and consumers flocked to these platforms. We expect smart speakers will be no different.

These findings indicate that to leverage voice technology, financial services brands need to work to address users’ privacy and security concerns.

To alleviate privacy and security concerns we recommend that financial brands:

- Stay informed of developments in smart speaker security features and invest where appropriate.

- Offer notifications, alerts, and other information via smart speaker with transactions taking place through traditional models to develop user confidence.

- Look at other common interactions that are fairly straightforward and find the ways voice interaction could reduce friction (e.g., “why do I have to log in to my phone to do X?”)

- Consider developing for voice-enabled devices that include a visual component (Amazon Show, or casting to a television).

For more details, download the full financial services findings report: Research-based insights for designing financial services voice interactions.